For Donors

General Information

Donations are the most important part of the Arizona Adventist Scholarship program as they provide the scholarships for students. Through these donations, families are better able to afford an Adventist education that might not be possible otherwise.

As part of your donation, you may recommend a school and/or student for a scholarship. “A donation, however, cannot be made on the condition that a particular student gets a scholarship, nor can the School Tuition Organization give a scholarship solely on the basis of a donor recommendation.” (A.R.S. §43-1603 (B) (3) The Arizona Adventist Scholarship Board has sole authority to determine who is awarded a scholarship.

Some children attending Adventist schools are receiving scholarships from one or more School Tuition Organizations. A couple of these will not allow the child to receive a concurrent scholarship from Arizona Adventist Scholarships, Inc. (AASI). If you have a question about this, please contact the AASI office.

Donations can be made in person, by mail, online, or via phone call to the AZ Adventist Scholarship office. Scholarships are awarded four times per school year in October, December, February and May. To have your donation included in a particular award date, plan on donating at least three weeks in advance of the award month.

A school tuition organization cannot award, restrict or reserve scholarships solely on the basis of recommendation. Also, a taxpayer may not claim a tax credit if the taxpayer agrees to swap donations with another taxpayer to benefit either taxpayer’s own dependent. You may not designate your own dependent as a potential recipient. (A.R.S. §43-1603)

How Tax Credits Work

A tax credit is different than a normal donation made to a charity. Instead of reducing your taxable federal income, it directly reduces your state tax liability (the state tax you pay that your employer deducts from your paycheck or what you are billed at the end of the tax year).

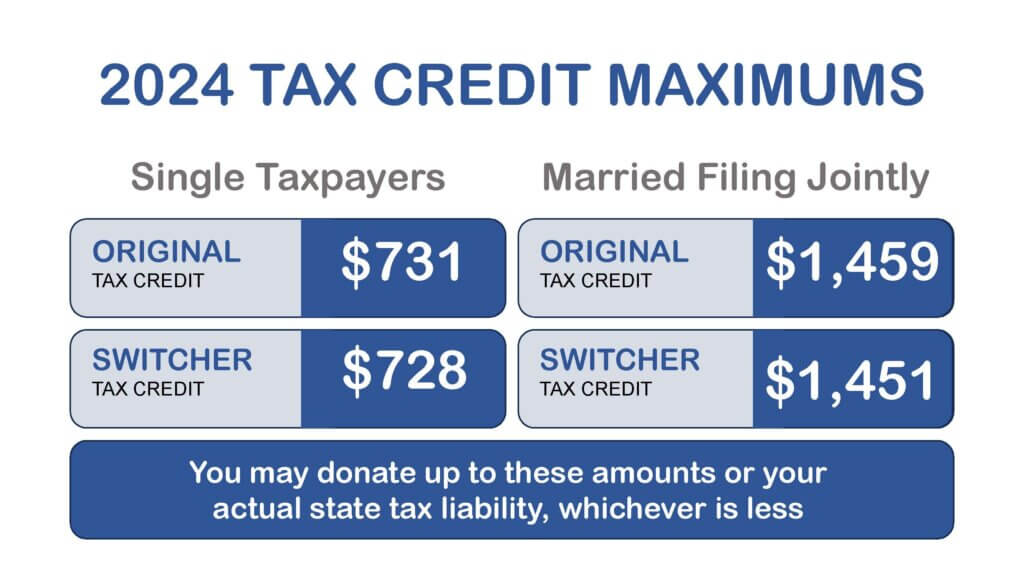

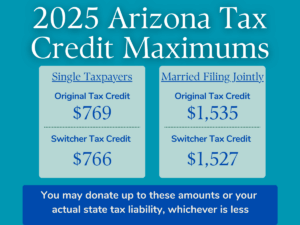

Each year Arizona State sets a cap on the donation limit for single tax filers and those filing taxes as married/joint. This determines the maximum amount taxpayers can expect to receive as dollar-for-dollar credit against their tax liability. In 2024, this amount is $1,459 for single taxpayers, and $2,910 for married taxpayers filing joint.

To obtain the tax credit, donors must report their donation to the Department of Revenue either on paper tax form or via an online tax filing program, whichever filing method you utilize. Donations can be made up to April 15 each year but needs to be made prior to filing your taxes. Tax credit up to April 15 can still be claimed on the previous year’s tax year.

Donations must be made through AASI, not sent to a church or to the child’s school to receive a tax credit from the State. Donations are received and distributed by AASI in the form of tuition scholarships.

For additional information on how the tax credit program works, please watch the “How Tax Credits Work” slideshow on the home page.

The Tax Credit Program – Two Important Parts

There are two parts to the Tax Credit program, the “Original” portion, and the “Switcher (also called PLUS/Overflow) portion. Each benefit a different student population.

The “Original” portion is so named as it was part of Arizona state’s original tax credit plan of 2002. Funds that are part of the Original plan benefit children enrolled full time in an AZ Adventist school who also have a parent or guardian that lives in Arizona. Each student must also have a current scholarship Application and Income Declaration on file with the AASI office.

Donors must contribute the maximum allowed amount in the “Original” portion of the program before donating under the second, or “switcher” part of the tax credit program. That amount is $738 for a single taxpayer, $1451 for a taxpayer filing married/joint.

The “Switcher” (PLUS/Overflow) portion of the tax credit plan was established by the State in 2012. This part of the plan benefits only students that have met eligibility requirements above AND have “switched” from public to private school, are enrolling or currently enrolled in a private school kindergarten, students enrolling or currently enrolled in a private preschool program for children with disabilities, or children that are dependents of a member of the armed forces of the United States who is stationed in Arizona pursuant to military orders. A student that received a switcher individual scholarship under one of the above criteria in a prior year and the child continued to attend a private school in subsequent years is also eligible.

Donors that contribute the maximum allowed amount under the State’s capped donation amount as a single or married taxpayer, who also recommend a student for a scholarship, need to be aware that the recommended student may only be awarded the “Original” portion (roughly half) of the total donation if that student is not also a verified “switcher” student. The “switcher” portion will be made available for only eligible switcher students.

Practical Examples of How Tax Credits Work

To better understand how tax credits work, CLICK HERE TO SEE SEVERAL DESCRIPTIVE FAMILY SCENARIOS.

How to Donate

Determine the amount of your tax liability. This will give you an idea of your maximum donation that you can claim as a tax credit as long as it doesn’t exceed the state-set donation limit for the current year.

- Look at your paystubs. What amount is being withheld each pay period? Calculate the annual amount withheld based on number of pay periods per year.

- Look at your W-2 tax form for the prior tax year. Note the amount of AZ state taxes noted on the bottom of the form.

- Look at last’s year state tax return. Note the amount of AZ state tax that you paid. If your financial status has remained about the same as the previous year, this is a good indication of the current year’s tax liability.

- Contact your tax consultant for information as to your tax liability

Make a Donation Now

Donation Options & Preparation Tips:

- Know the amount you wish to donate.

- If you are donating online or calling in a donation to the AASI office, have a credit/debit card in hand.

- If you have a school or student scholarship recommendation, have that information handy.

- If you are mailing in a donation check, a brochure with pre-printed mailing envelope is available by contacting the AASI Office. We will mail it to you. Phone: (480) 991-6777 Ext 150 or (480) 519-1379. If you are recommending a student or a school, please note that information on the check.

- Submit your donation by any of the methods shown below:

Click the Donate Online button above to be taken directly to our online donation portal

By Phone

Not familiar with Computers? We’ll take your donation by phone!

Call: (480) 519-1379

By Mail

Fill out the Donor Form and mail your donation with a check payable to: AASI, P.O. Box 12340, Scottsdale, AZ 85267

Hand Deliver

Hand deliver your donation to: AASI, 13405 N. Scottsdale Rd, Scottsdale, AZ 85254

Note: A school tuition organization cannot award, restrict or reserve scholarships solely on the basis of donor recommendation.

A taxpayer may not claim a tax credit if the taxpayer agrees to swap donations with another taxpayer to benefit either taxpayer’s own dependent. A.R.S. § 43-1603

How to Claim Your Tax Credit

For Taxpayers Filing Paper Tax Forms

- File your Donation Receipt

Receipts are mailed monthly to donors. Keep your receipt and file it when you submit your state taxes. - Claim Your Tax Credit

In order to claim your tax credit donation, you must file Arizona tax forms 301 and 323 along with your Arizona income tax forms. If you made a Switcher (PLUS/Overflow) donation, you must also file Arizona tax form 348. - Forms and instructions for completing them are available from the Arizona Department of Revenue. Click on the links below for tax year 2021 forms and instructions for completing them:

-

2024 Form 301

Form & Instructions: https://azdor.gov/forms/tax-credits-forms/nonrefundable-individual-tax-credits-and-recapture -

2024 Form 323

Form & Instructions: https://azdor.gov/forms/tax-credits-forms/credit-contributions-school-tuition-organization -

2024 Form 348

Form & Instructions: https://azdor.gov/forms/tax-credits-forms/credit-contributions-certified-school-tuition-organization-individuals - If you need further assistance regarding tax filing or completion of tax forms, please consult your tax preparer. The AASI office cannot assist with tax preparation.

For Taxpayers Self-Filing Via Commercial Online Computer Programs

- These programs normally prompt you to provide your information regarding tax credit donations for private schools. Follow the prompts and complete the information requested.